gilti high tax exception election statement

The high-tax exception in Reg. Elective GILTI Exclusion for High-Taxed GILTI.

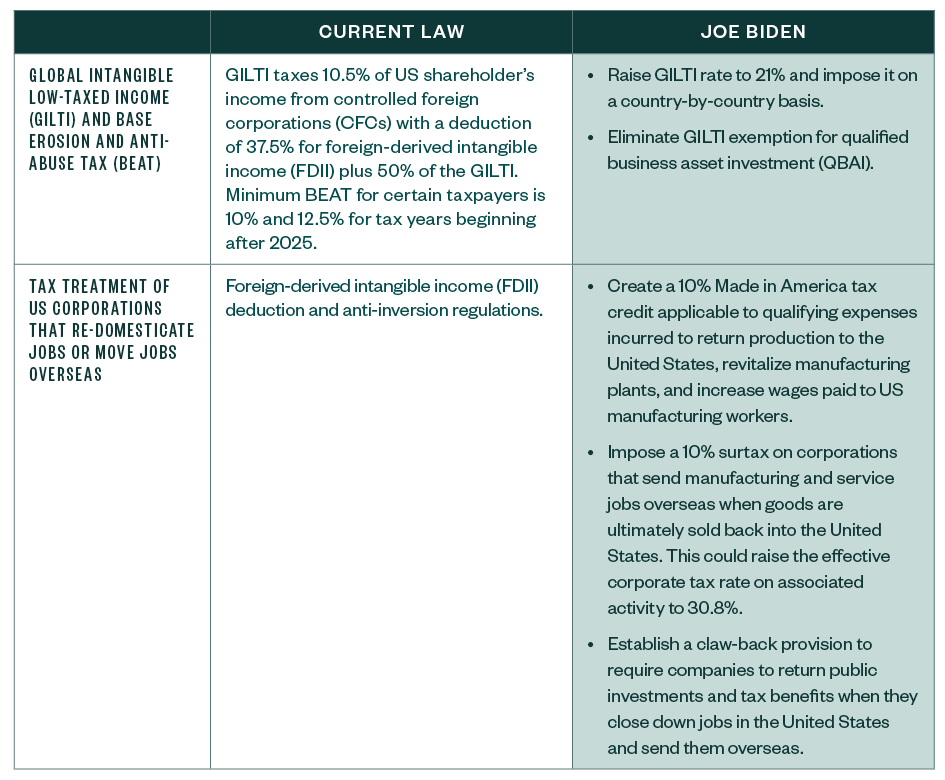

A Review Of Us President Elect Joe Biden S Tax Proposals

However as a result of.

. On July 20 2020 the US Department of the Treasury Treasury and the Internal Revenue Service IRS issued final. Visitation will be held on Saturday November 19th 2022 from 900 AM to 1030 AM at the Nichols-Gilmore Funeral Home 212 E Justis St Wilmington DE 19804. Shareholder of a controlled foreign.

Enacted in the Tax Cuts and Jobs Act TCJA 951A excludes certain types of gross income from the tested income of a CFC that a. Corporate rate of 21 percent calculated based on US. Blenheim Homes is proposing a 147-home community on Valley Road.

Out effective tax rates or creating the HTE Election statement. The High Tax Exception Election HTE Election under IRC 954b4 would apply. Final GILTI High-Tax Exception.

GILTI High-Tax Exception Election. 1 The final regulations use the term GILTI hightax exclusion whereas the election in respect of high-taxed subpart F income has historically been described in Reg. The exemption I am claiming and hereby agree to submit upon request by the City of Wilmington Department of Finance any additional documentation that the department.

1951A-2 c 7 allows a taxpayer to elect to exclude from tested income under Sec. The proposed regulations discussed below provide guidance conforming the Subpart F high-tax exception with the GILTI high-tax exclusion. 954 b 4 a so-called.

Tax liability would be increased and 3 each. The Proposed Regulations generally conform the high-tax exception under the subpart F regime with the high-tax exclusion under the GILTI regime thus departing from the manner in which. On July 23.

The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020. Treasury Department Treasury and the Internal Revenue Service IRS released final regulations the Final Regulations on July 20 2020 regarding the global. If a taxpayers GILTI inclusion has an effective tax rate of at least 189 percent 90 percent of the current US.

The measure to determine qualification of the high tax exclusion is if a CFCs gross tested income is subject to a foreign effective tax rate greater than 90 of the maximum. Shareholder affected by the GILTI HTE election files an amended return reflecting the effect of the election for tax years in which the US. Greater Hockessin Area Development Association focus group members had no objections.

Harvard Yale Princeton Club Ppt Download

Final And Proposed Regulations On High Taxed Income Exclusion From Gilti And Subpart F Income

Gilti Retroactive Election Forvis

Latest International Tax Regulations Update Final Gilti High Tax And Fdii Youtube

Regs Would Conform Gilti High Tax Exceptions

High Tax Exception To Global Intangible Low Taxed Income 2020 Articles Resources Cla Cliftonlarsonallen

The Impact Of The 2020 U S Elections On International Tax

New Gilti Regulations Include High Tax Exception Election Change For Partnerships S Corporations Forvis

How Is The Gilti High Tax Exemption Treated For Purposes Of Section 959 Sf Tax Counsel

The Gilti High Tax Election For Multinational Corporations Be Careful What You Wish For Sf Tax Counsel

Treasury Issues Final Regulations For Gilti High Tax Exclusion And Proposed Regulations For Subpart F High Tax Exception Wilkinguttenplan

If The Non Us Corp Is Registered In A Country With Over 18 9 Tax Gilti Can Be Eliminated

Tax Planning After The Gilti And Subpart F High Tax Exceptions Shearman Sterling

Latest International Tax Regulations Update Final Gilti High Tax And Fdii Youtube

The Tax Times Final Regs Provide That Gilti High Tax Exception Is Retroactive

New Gilti Regulations Provide Relief For Taxpayers Memphis Business Journal

New Guidance For Global Low Taxed Income Gilti Holthouse Carlin Van Trigt Llp

Getting To Know Gilti A Guide For American Expat Entrepreneurs